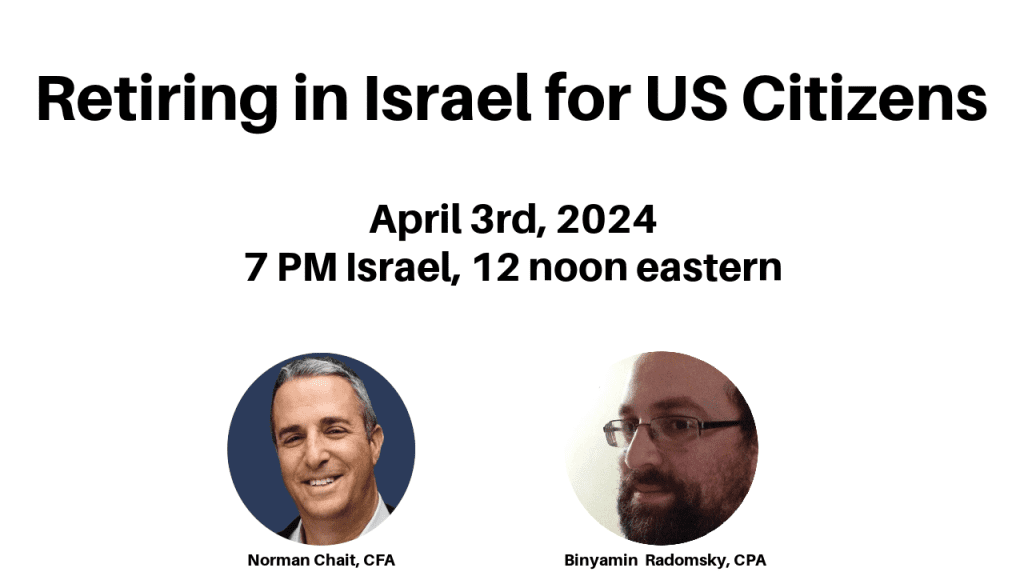

Retiring in Israel for US Citizens – Taxation and Planning Issues

Retirement and taxes for US persons in Israel can indeed be a complex endeavor, especially if the retirement assets (e.g. IRA and 401k) are in the US. This webinar will focus on the key issues in preparing for your retirement, specifically taxation and financial planning. We will also touch briefly on Social Security and inheritance …

Retiring in Israel for US Citizens – Taxation and Planning Issues Read More »