It has certainly been a rough year in the market. In fact, the first six months of 2022 was the worst start to the year for both stocks and bonds in decades. We believe that when markets fall, good opportunities may avail – this time in the bond market.

2022 Market Review

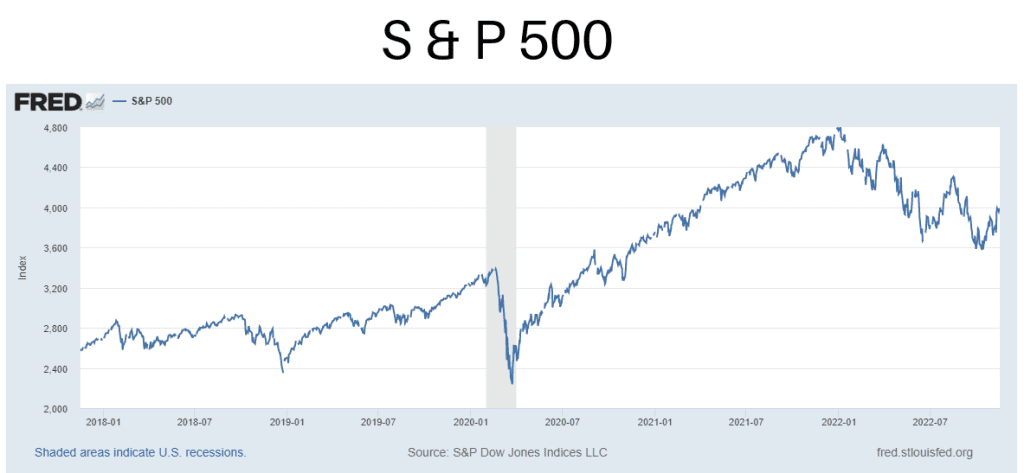

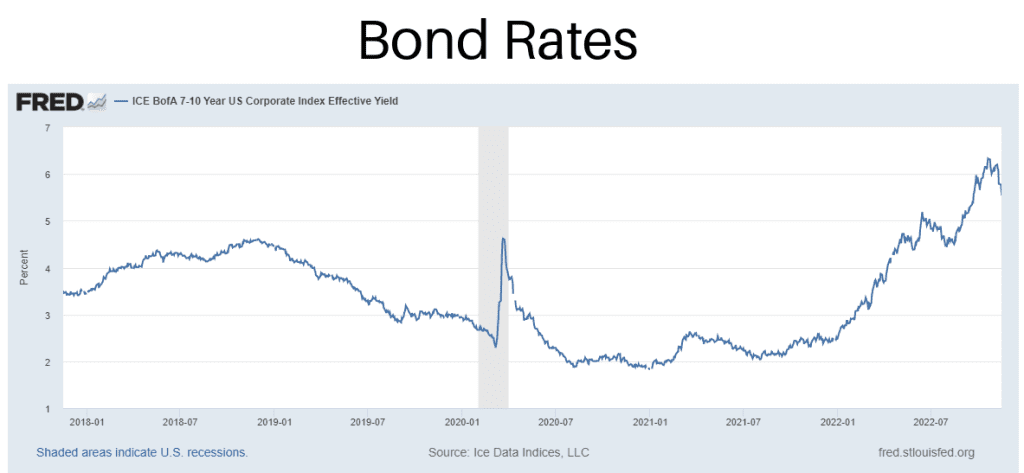

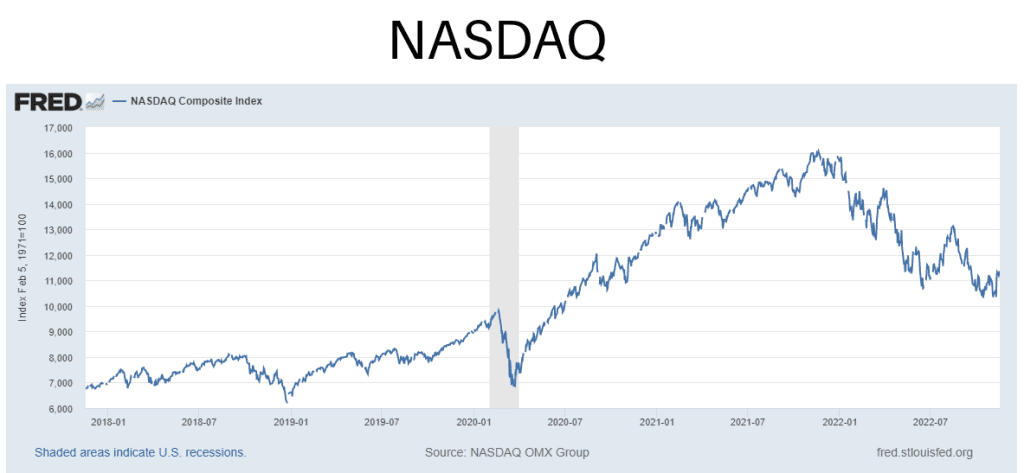

The S&P 500 has fallen by about 18% and the NASDAQ by around 27% through the end of October this year. Over the same time, the yield on investment grade corporate bonds has risen from 2.6% to 6.1%, causing bond prices on 10-year corporates to fall by about 20% YTD for the year (please see charts below). While there is a small relief rally in November (owing to lower inflation expectations – too soon to spot if this indicates a trend), the main principles here still apply.

Just nine months ago the FED funds rate was near zero percent with short-term rates pretty close, and even long-term rates were around only 2%. Fast forward to now, and the Federal Reserve has been raising rates much quicker than the market has anticipated to help fight inflation, and both short-term and long-term rates have followed suit.

Time to revisit how to attain your long-term investment goals

We believe this new higher interest rate regime may provide a good opportunity to take a look at your overall investment plan and asset allocation, and see how bonds may supplement your portfolio.

Before we go any further, it’s useful to acknowledge that everyone who invests in the market should follow an asset allocation, or mix of stock, bonds, and other asset classes, that is specific to their personal risk tolerance. As your life changes, it may be time to adjust that allocation.

Market changes are a time to reflect upon the question of stocks vs. bonds and what the optimal mix of asset classes.

We believe now that adding incremental exposure to longer term bonds may allow you to still reach your long-term goals, whether that is funding retirement or saving toward a vacation home or higher education.

By the way, none of what we are discussing in this blog may be interpreted as financial advice specific to any one individual. For recommendations specific to your situation, please consult with your financial and/or tax advisor.

Is it time to buy bonds?

As mentioned above, rates on longer term investment grade corporate bonds have now moved to around 6.2% If rates were to come down in the future there would be a greater chance for price appreciation in bonds as well.

Even on a shorter-term basis, this might be a good time to look at any cash and funds you have lingering in a savings or checking account. While rates for these types of accounts have increased, they have not gone up as much as some other options such as short-term Treasuries. Any funds earmarked for less than three years may benefit from taking a look at other options. For example, rates on 1 year treasury bonds yields have risen from near zero percent to over 4.5% as the year has gone on. Just like it is a good idea to check your estate plan and insurances for coverages and premiums from time to time, it is not a bad idea to make sure your money is also working as optimally as possible.

Is it the right time for you to buy bonds?

We hope you have enjoyed our article on what the right time to buy bonds is. Did we inspire you to rethink your asset allocation?

If so, we are expat financial advisors located in Israel and the US, serving expats globally. If you are moving to Israel or another country and don’t know where to start when it comes to the financial side of things, please contact us.

If you would like to receive our updates, please sign up for the Nardis Advisors newsletter.

SUBSCRIBE to the Nardis Advisors YouTube channel or ongoing updates related to the markets, economy, and finance for expats.

CONTACT US to schedule a time to speak with Nardis Advisors regarding your portfolio and personal financial plan.

Michael Reed, Associate Advisor Nardis Advisors LLC, November 16th, 2022.

Disclaimer: Nardis Advisors LLC (“Nardis”) is a Registered Investment Advisory Firm regulated by the U.S Securities and Exchange Commission in accordance and compliance with applicable securities laws and regulations. Nardis does not render or offer to render personalized investment advice through this medium. The information provided herein is for informational purposes only and does not constitute financial, investment or legal advice. Investment advice can only be rendered after delivery of the Firm’s disclosure statement (Form ADV Part 2) and execution of an investment advisory agreement between the client and Nardis.

Sources

Ice Data Indices, LLC, ICE BofA 7-10 Year US Corporate Index Effective Yield [BAMLC4A0C710YEY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLC4A0C710YEY, November 2, 2022.

S&P Dow Jones Indices LLC, S&P 500 [SP500], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SP500, November 2, 2022.

NASDAQ OMX Group, NASDAQ Composite Index [NASDAQCOM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NASDAQCOM, November 2, 202216