We will take a deeper look at the top financial questions posed to us in past webinars. We will cover the most perplexing US expat questions pertaining to taxation, estate planning, Social Security, Medicare, Aliyah finances and more.

5785 reasons to attend – (here are some key items that came up on previous webinars)

- Where do I pay my taxes and when does this change?

- How can I file for social security and how does WEP affect me?

- What documents should I have in place?

- Do I need an Israeli will? How is my estate executed if I pass away in Israel.

- How relevant is all the financial and estate planning I did in the US, now that I live in Israel?

- Why should I change how I do things just because I made Aliyah?

- Can I still do a backdoor Roth IRA contribution?

- How do spousal, divorcee and survivor social security benefits work?

- My spouse is not a US citizen. How do we plan our investments and estate?

And many more – and there will be lots of time for Q&A

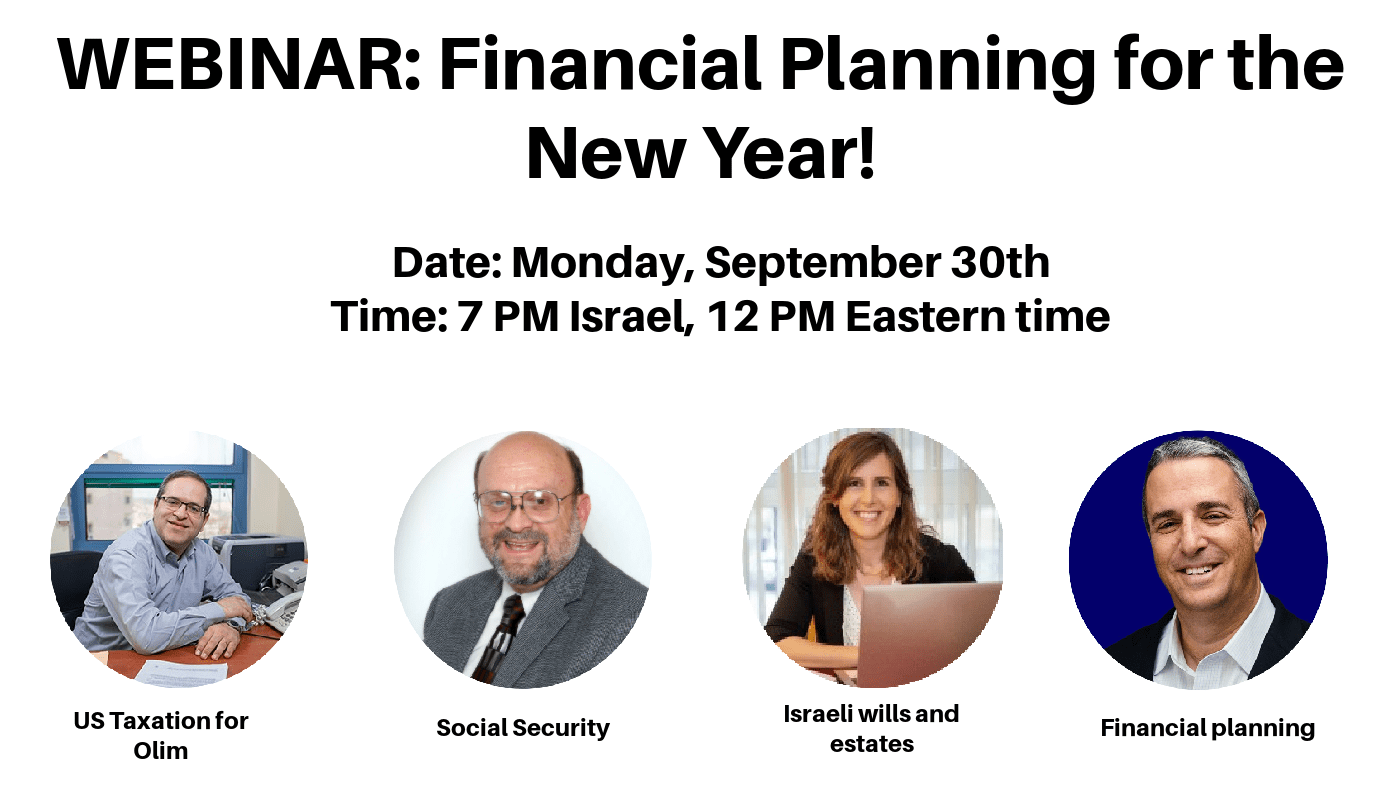

Date: Monday, September 30th

Time: 7 PM Israel, 12 PM Eastern time

Speakers:

Larry Stern, CPA, Partner, Aboulafia Avital Shrensky & Co CPA

Tom Clark, Social Security speaker and consultant

Mirit Hoffman, Israeli Lawyer, STEP member, and Gerontologist

Norman Chait, CFA, Managing Principal, Nardis Advisors LLC

Register below or email mreed@nardisadvisors.com and we’ll see you there!

About Larry Stern

Larry Stern is a US CPA practicing in Israel for the last 15 years and Partner at Aboulafia Avital Shrensky & Co. His firm provides both US and Israeli tax consulting and compliance work (tax returns, audit) for individuals, companies, partnerships, non-profit organizations and more.

Larry has over 25 years of experience in the field of international tax with over 12 years of experience at Big 4 firms in the US and Israel. For individuals, Larry specializes in taxation for dual citizens, relocations, executive compensation and its international complications, overseas investments by non-US persons, and retirement planning.

About Tom Clark

Tom Clark spent 33 years working for Social Security as a claims representative, operations supervisor, field representative and public affairs specialist before retiring in 2011. Tom has made more than 6000 speeches and talks-more than anyone in the history of the Social Security Administration. As a Social Security employee, Tom received two Social Security Commissioner’s Citations, Social Security’s highest award, and four Deputy Commissioner of Communications Citations for excellence in explaining the complexities of Social Security and Medicare entitlement. Tom is now a self-employed Social Security speaker and consultant.

Tom has a Bachelors degree from Oklahoma Baptist University.

About Mirit Hoffman

Mirit Hoffman is an attorney with 25 years’ experience and a Gerontologist. Her specialty is estate planning and elder law, including the complexities of interfamilial and intergenerational ties as well as preparing enduring powers of attorney, wills and prenups and financial agreements for people in their second / third relationships.

She is trained and has experience in U.S. and Israeli Tax Law, allowing her to view in totality complex estate matters involving dual citizenship while considering each client’s particular and complex needs.

She is a member of the Global Society of Trust and Estate Practitioners (STEP) and she lectures regularly on the importance of Estate Planning and Enduring Power of Attorney. She writes a column on the relationship between children and their adult parents on various Hebrew news sites and a blog in the Times of Israel.

Mirit has a podcast, called “Golden Topics – Significant Crossroads for Seniors”, where she hosts a variety of professionals who work with and empower senior citizens in various areas in their life.

About Norman H. Chait, CFA

Norman Chait is the Managing Principal of Nardis Advisors, an independent Registered Investment Advisor based in Scarsdale, NY, focused on building customized investment portfolios for a select group of individuals and families, especially for US citizens living overseas. He has 29 years of experience in all aspects of the traditional and alternative investment universe.

Norman received an MBA from Columbia University in 1995 (beta gamma sigma), and a Law Degree from Hebrew University of Jerusalem in 1988. He served in the Judge Advocate General Division of the Israel Defense Force from 1988-1993 and is a graduate of the Israel Defense Force Officer’s School. Norman is a Chartered Financial Analyst and Member of the New York Society of Security Analysts. He is also a licensed Portfolio Manager in Israel under the auspices of the Israel Securities Authority.

Norman moved back to Israel in 2016, after spending 23 years in New York, and lives in Zichron Ya’akov.

Disclaimer

Nardis Advisors LLC (“Nardis”) is a Registered Investment Advisory Firm regulated by the U.S Securities and Exchange Commission in accordance and compliance with applicable securities laws and regulations. Registration does not imply a certain level of skill or training. Nardis does not render or offer to render personalized investment advice through this medium. The information provided herein is for informational purposes only and does not constitute financial, investment or legal advice. Investment advice can only be rendered after delivery of the Firm’s disclosure statement (Form ADV Part 2) and execution of an investment advisory agreement between the client and Nardis.