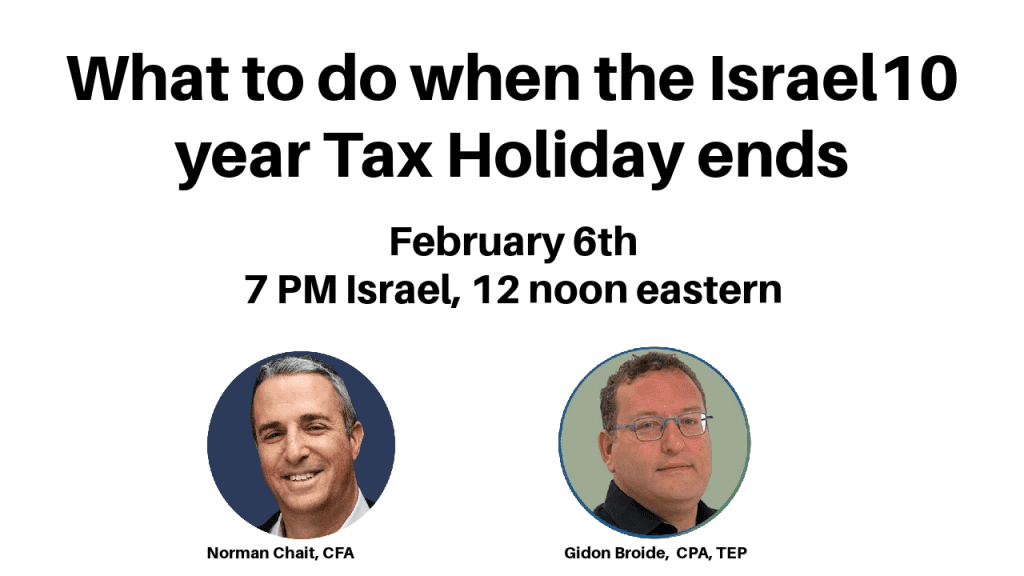

WEBINAR DETAILS

Date: Tuesday, February 6th, 2024

Time: 7 pm Israel, 12 noon eastern

The Israeli Income Tax Ordinance provides benefits to new immigrants (Olim) and returning citizens, making Aliyah an attractive option. But what do you do when the 10 Year Tax Holiday ends?

Attend our webinar and learn:

- How the Israel 10 Year Tax Holiday benefits Olim and returning residents

- What steps you need to take to prepare for it ending

- What you may not realize about pension income, foreign currency deposits, and income tax

Nardis Advisors welcomes Gidon Broide, CPA, TEP as our guest speaker.

Register using the button below or email nchait@nardisadvisors.com.

About Gidon Broide

With more than 20 years of experience in audit, tax and consulting, Gidon advises families, trusts, individuals and corporations, as well as local and foreign professional advisors and trustees. Gidon believes in knowing our clients well and understanding their concerns. He is considered an expert on taxation of trusts in Israel. He is a qualified CPA in both Israel and the US and a member of STEP (Society of Trust and Estate Professionals).

About Norman H. Chait, CFA

Norman Chait is the Managing Principal of Nardis Advisors, an independent Registered Investment Advisor based in Scarsdale, NY, focused on building customized investment portfolios for a select group of individuals and families, especially for US citizens living overseas.

He has 29 years of experience in all aspects of the traditional and alternative investment universe.

Norman received an MBA from Columbia University in 1995 (beta gamma sigma), and a Law Degree from Hebrew University of Jerusalem in 1988.

He served in the Judge Advocate General Division of the Israel Defense Force from1988-1993 and is a graduate of the Israel Defense Force Officer’s School.

Norman is a Chartered Financial Analyst and Member of the New York Society of Security Analysts. He is also a licensed Portfolio Manager in Israel under the auspices of the Israel Securities Authority.

Norman moved back t0 Israel in 2016, after spending 23 years in New York, and lives in Zichron Ya’akov.

Disclaimer

Nardis Advisors LLC (“Nardis”) is a Registered Investment Advisory Firm regulated by the U.S Securities and Exchange Commission in accordance and compliance with applicable securities laws and regulations. Registration does not imply a certain level of skill or training. Nardis does not render or offer to render personalized investment advice through this medium. The information provided herein is for informational purposes only and does not constitute financial, investment or legal advice. Investment advice can only be rendered after delivery of the Firm’s disclosure statement (Form ADV Part 2) and execution of an investment advisory agreement between the client and Nardis.