In this article, we will discuss pandemic recovery stock trends. Markets started 2021 off strongly, with a continuation of the Corona-related “work and play at home” themes that have dominated since March 2020. Since mid-February however, they have cooled off somewhat and we are seeing a more range-bound environment, albeit with formerly out-of-favor stocks playing some catch up. There is sector rotation on certain days, only to see the opposite trend the following day. The tech-laden NASDAQ is now 7% off it February highs, while the more “old school’ Dow Industrials Index is within one percent of its most recent high.[i]

The current debate within Nardis’s investment team revolves around whether one is better off investing in:

- A beaten up sector, on the anticipation that it will recover – e.g. travel, or;

- An overpriced technology trend that has benefited from the stay at home Corona environment.

In the former case, a sudden setback in the war against COVID-19 could cause a delay, which could severely impact “recovery” stocks. We are not out of the woods yet with all things related to Corona. We see that infection rates are down in the US, and vaccinations are up, but we are still far from declaring victory.

In the latter case, one has to temper some of the rhetoric that encourages ignoring valuation metrics.

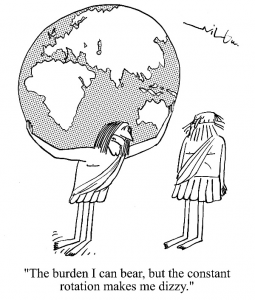

And while we are trying to figure out the nature of the current rotation, or twist (as it seems to be back and forth between growth and value, old and new), unanticipated specific situations have also made an impact on markets and on pandemic recovery stock trends.

Firstly, last week’s grounding of a large container ship in the Suez Canal caused a huge backlog in delivery times, and we are still witnessing the inflationary impact of this discrete event.

Secondly, the Archegos Hedge Fund (come family office, come levered trader) was forced to liquidate up to $20 billion in stocks, impacting some Chinese stocks as well as European banks.

Summary of Pandemic Recovery Stock Trends

To summarize what do we know, or believe to be true:

- President Biden signed the latest stimulus bill, which included a further $1,400 check per person – $2,800 per couple and $1,400 per dependent child. We believe that much of this money is once again finding its way into the stock market directly. And it will focus on high growth technology names.

- The work and play-at-home trends which were accelerated during the Corona pandemic will not disappear as things normalize. These are secular trends that are not going away.

- At the same time, we cannot ignore “recovery” and more importantly inflation plays. The economic recovery may be beginning in the US and Asia (Europe still lags), but it is uneven and there are shortages of many goods.

- In the past stocks have done well in environments of rising longer-term rates – especially after rates have been exceedingly low.

- Market recoveries often precede economic recoveries.

- Cathy Wood of Ark Investments is launching a space-exploration exchange-traded fund, her first new ETF in two years. Perhaps she is looking for a vehicle to continue to capture the lofty valuations of some of her favorite stocks.

We believe that if longer-term interest rates stabilize at current levels, then it is possible that we see a further market rally.

We hope you have enjoyed our blog on pandemic recovery stock trends. If you would like to receive our updates, please sign up for the Nardis Advisors newsletter.

SUBSCRIBE to the Nardis Advisors YouTube channel or ongoing updates related to the markets, economy, and finance for expats.

CONTACT US to schedule a time to speak with Nardis Advisors regarding your portfolio and personal financial plan.

Norman H. Chait, CFA Managing Principal, Nardis Advisors LLC, April 1, 2021

[i] Source: Cartoonstock 453352

Disclaimer: Nardis Advisors LLC (“Nardis”) is a Registered Investment Advisory Firm regulated by the U.S Securities and Exchange Commission in accordance and compliance with applicable securities laws and regulations. Nardis does not render or offer to render personalized investment advice through this medium. The information provided herein is for informational purposes only and does not constitute financial, investment or legal advice. Investment advice can only be rendered after delivery of the Firm’s disclosure statement (Form ADV Part 2) and execution of an investment advisory agreement between the client and Nardis.