Dear fellow practitioners, CPAs, attorneys, and other professionals, Welcome to the sixteenth edition of our “Dreidel” newsletter about planning and investment issues of US citizens living overseas.

This month, Mike Reed talks about about the current state of the US markets, and places this in a longer-term context.

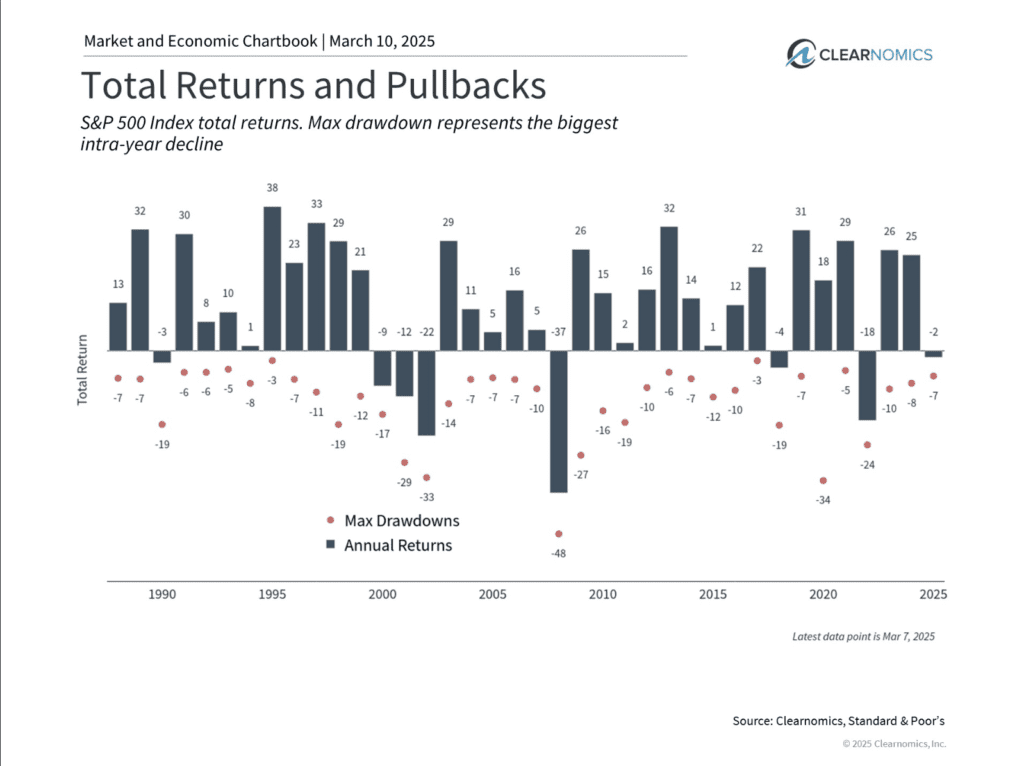

The US stock market has had a rocky start so far this year. According to data from Morningstar, the S&P 500 is down 13.93% through April 7th, and the growth-heavy NASDAQ is down 19.2%. While this decline may be driven by concerns such as trade wars or fears of slowing earnings growth, it’s easy to feel uneasy. However, it’s important to remember that market drawdowns like this are a common and natural part of investing! As the chart below illustrates, the market typically experiences a drop each year, but still generally manages to end positively by December.

In some years, the reasons for a market downturn are obvious, such as the COVID-19 pandemic in 2020 or the Financial Crisis in 2008. In other years, it can be harder to pinpoint why the market sold off.

The key takeaway is that market pullbacks are inevitable. That’s why having a solid long-term investment plan, one that accounts for your risk tolerance and goals, is crucial. Now may be a good time to re-evaluate your portfolio to ensure it still aligns with your objectives.