Dear fellow practitioners, CPAs, attorneys and other professionals. Welcome to the first edition of our “Dreidel” newsletter about planning and investment issues for US expatriates, i.e. US citizens living overseas. We will publish a new “spin” every month!

While we mostly focus on Americans living in Israel, we do also have clients in the UK, South Africa, Australia and the EU. We reckon about 75-80% of expat money matters are related to the US side of the equation. So, while we may more often than not use Israeli examples, they may be relevant to other countries, too.

We focus this newsletter on Medicare, with comments from my colleague Mike Reed. Next month we will discuss RMD’s and year-end planning items.

Medicare

Well…it is that time of year again, when Americans aged 65 or older are making their decisions on Medicare. People turning 65 will need to decide which Medicare plan to choose for the first time. Those who have been on Medicare they will need to look and see if there are any changes they would like to make to their current plan. The open enrollment period runs through December 7th.

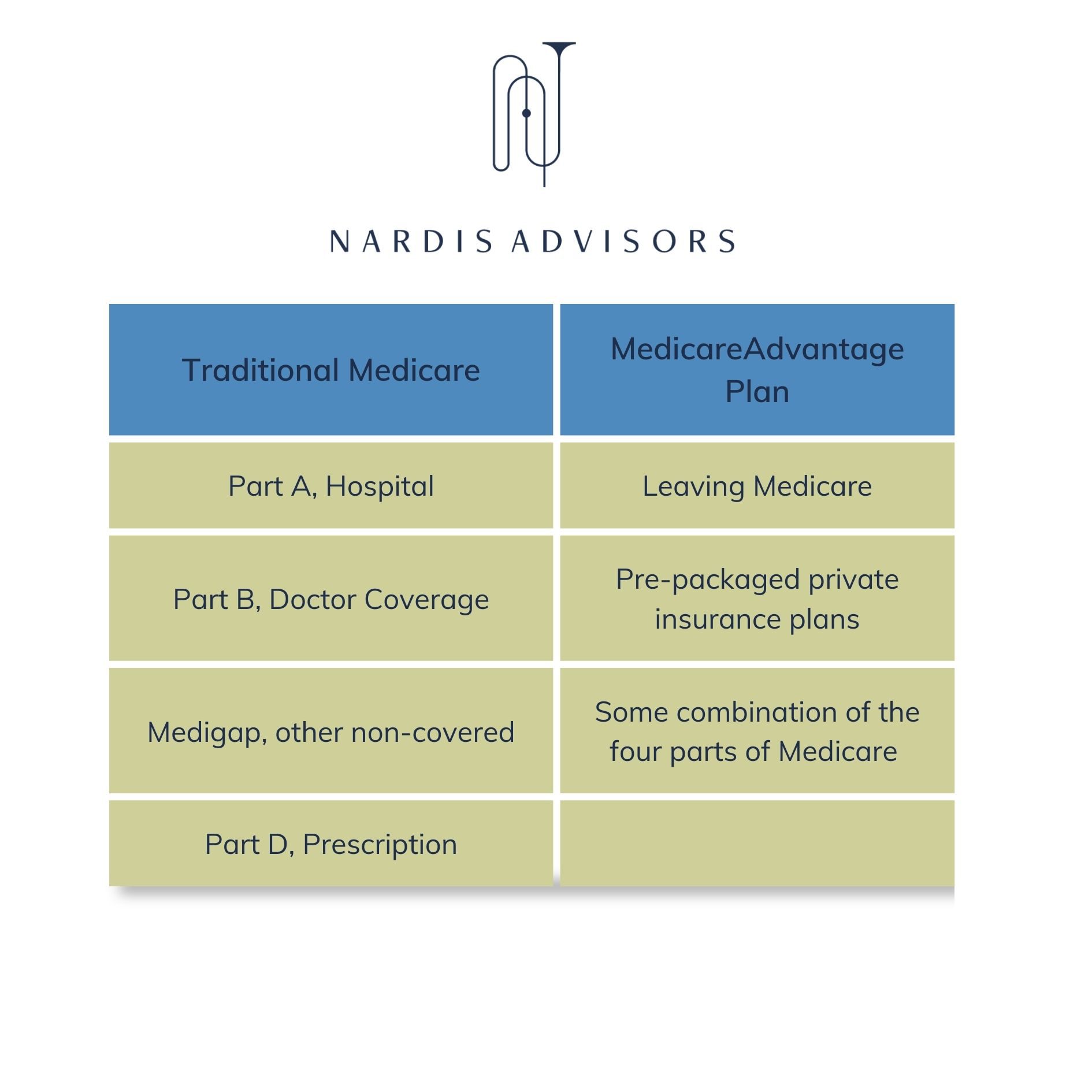

The options in Medicare can be broken down into two camps:

- Sticking with traditional Medicare Parts A (which covers hospital stays and is “free” to people who have worked 10 years) and B which covers doctor visits and the premium can be $164.90 to over $550 a month depending on income. People usually add a Medigap Plan to pay for hospital and doctors costs which are not covered under Parts A and B which runs on average $155 a month, and a Part D drug plan which is an average of $34 a month.

- A Medicare Advantage Plan that is offered by a private insurance company. This takes Parts A and B and packages them with services the Insurance company chooses to offer. Roughly 90% of the commercials you see on TV are for Medicare Advantage Plans. The cost for these plans can vary greatly as there are many options.

Both paths offer their advantages and disadvantages.

We often get asked by our US expat clients who have moved overseas or who are going to move overseas what they should do about Medicare. Like most things in life, it depends.

Scenario A: someone who has moved overseas, has good local medical insurance, and does not plan on being back in the US very often, except for brief visits. In this case dropping Medicare could make sense as paying premiums for services you may never use could be a wasted cost. Often if you are traveling overseas, you can buy a short-term travel insurance policy.

Scenario B: this is more complicated and involves persons who think they may be back in the US quite frequently, for a few months a year, or may consider moving back to the US in the near-to-medium term.

In this case keeping Medicare and paying the premiums can make sense so that you are not hit with the premium penalty (which is 10% for every 12 months you were not enrolled). This penalty can add up and significantly add to premiums for the rest of one’s life, so paying now can potentially save a lot of money in the long run.

In summary, Medicare planning for US expats may add a few extra layers, so consulting with an expert can help shed light on some of the more complicated decisions. If there are any questions, please contact us.

Disclaimer

Nardis Advisors LLC (“Nardis”) is a Registered Investment Advisory Firm regulated by the U.S Securities and Exchange Commission in accordance and compliance with applicable securities laws and regulations. Registration does not imply a certain level of skill or training. Nardis does not render or offer to render personalized investment advice through this medium. The information provided herein is for informational purposes only and does not constitute financial, investment or legal advice. Investment advice can only be rendered after delivery of the Firm’s disclosure statement (Form ADV Part 2) and execution of an investment advisory agreement between the client and Nardis.