With Elton Mwangi

If you’ve been reading the news lately, you will most certainly know that the Trump administration’s stance on tariffs has plunged the global economy into a new era of uncertainty. But what may that mean for you as a US expat?

Before we get started, we’ve written these blogs about moving to and living in Israel which you may enjoy.

What to do when you get kicked out of your US brokerage account

Can one use a US Power of Attorney in Israel, (and vice versa)?

Checklist for moving to Israel

Financial planning for US citizens living abroad

Selling a house in Israel as a US citizen

Why US Expats should look before they leap into a Roth 401k

Compliance with reporting of foreign assets: tips for US expats to avoid stress

What expats need to know about Brokerage Accounts for non-US residents

And now let’s get into the blog!

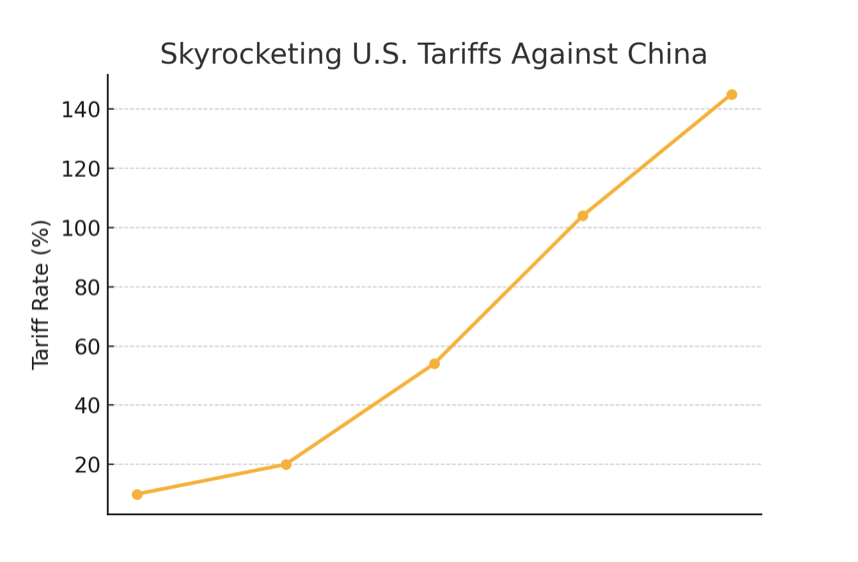

The Trump administration has triggered a seismic shift in global trade with its aggressive tariff agenda. Currently, all countries exporting to the U.S. face a temporary, across-the-board 10% tariff, following a 90-day pause on previously steep, country-specific rates.

The recalibration follows a dramatic $3 trillion loss in U.S. stock market value, prompting a tactical pause to stabilize financial markets and open doors for trade talks with over 75 global partners.

Some paused tariffs include:

- European Union – 20%

- Israel – 17%

- Vietnam – 46%

- Thailand – 36%

- Cambodia – 49%

- Japan – 24%

China remains the outlier, facing a staggering 145% tariff, with proposals underway to push that even further—to 245%.

Yet, Trump’s strategy, aimed at reducing trade deficits and restoring manufacturing jobs, hasn’t come without further consequences. China’s retaliatory 125% tariff on U.S. goods has severely disrupted supply chains—especially in tech and manufacturing—and also left American farmers struggling to replace lost export markets.

Meanwhile, U.S. expats in Israel are feeling an unexpected pinch. From increased costs of imported American goods to slowed supply chains and shifting job dynamics, the impact of Trump Tariffs extends well beyond U.S. borders. For many expats, particularly in trade-heavy regions like Israel, these policies are reshaping day-to-day life and financial stability.

In a climate of uncertainty and volatility, one thing is clear: Trump’s tariffs are no longer just a domestic play—they’re a global force with ripple effects reaching Americans far from home.

How Trump Tariffs Are Disrupting Life for U.S. Expats in Israel

Increased Cost of Living

If you’ve strolled through a supermarket in Tel Aviv lately, you may have experienced sticker shock. Classic American staples like peanut butter have nearly doubled in price, thanks to tariffs driving up import costs. Those increases are inevitably passed down to consumers. It’s not just food—laptops, smartphones, and other U.S.-made electronics are starting to feel like luxury items, putting a strain on household budgets.

Currency Fluctuations

Many U.S. expats in Israel earn in U.S. dollars but live in a shekel-based economy. As trade tensions escalate, jittery global markets have led to volatile exchange rates. One week your dollar stretches comfortably; the next, it falls short. It’s an exhausting guessing game, turning everyday purchases into financial stress points.

Higher Business Costs

Small business owners abroad are facing tough choices. Take the expat café owner in Jerusalem whose signature desserts rely on imported pecans and high-grade American cocoa. With ingredient costs soaring due to Trump Tariffs, they’re forced to either hike prices or compromise on quality—neither of which is ideal when trying to maintain loyal customers.

Job Market Uncertainty

Israel’s booming tech sector is deeply intertwined with U.S. companies. But now, supply chain disruptions and rising operational costs caused by tariffs are causing hesitation. Expansion plans are being shelved, hiring freezes are taking hold, and expats working in these industries are facing increased uncertainty about job security and career progression.

Investment Anxiety

For expats with portfolios tied to U.S. exporters, these tariffs are more than just policy—they’re personal. Consider someone who’s invested in an American agricultural firm dependent on exports to China. Plummeting demand due to retaliatory Chinese tariffs has slashed revenues and dragged stock values down. For those relying on these investments for financial stability, it’s a source of mounting anxiety.

Shield Your Wealth with Strategy

If you’re not a financial expert, managing your own income, expenses, and investments can feel like sailing without a compass. Even if you’re confident in your skills, a professional opinion may uncover blind spots you may have missed.

Working with an expert on expat finances can help spot risks you may overlook, guide you toward smarter diversification strategies, And help you reallocate spending, legally optimize taxes, and stay grounded with financial decisions.

Have any question? Book your complimentary 15 minute consultation today and speak with of Nardis’ expert financial advisors.

Disclaimer

Nardis Advisors LLC (“Nardis”) is a Registered Investment Advisory Firm regulated by the U.S Securities and Exchange Commission in accordance and compliance with applicable securities laws and regulations. Registration does not imply a certain level of skill or training. Nardis does not render or offer to render personalized investment advice through this medium. The information provided herein is for informational purposes only and does not constitute financial, investment or legal advice. Investment advice can only be rendered after delivery of the Firm’s disclosure statement (Form ADV Part 2) and execution of an investment advisory agreement between the client and Nardis.