-

June 30, 2025|

- Articles

- |

- Expats

Can Americans In Israel Access Their Bank Accounts and Investments?The answer is yes… until it’s suddenly no. After being unexpectedly rerouted to Athens mid-flight during Israel’s Operation Rising Lion (we wrote a blog and a LinkedIn post about it), I found myself stranded for several days with nothing but a few bags, five kilos of Spanish cheese, and a long to-do list waiting for…

Blog

Keep up with our latest thoughts, updates, tips and case studies on expat finances.-

January 20, 2025|

January 20, 2025|- Moving to Israel

What to Prioritize Financially When Moving to IsraelMoving to a new country can be overwhelming, with many items to take care of – even more so when moving to Israel from the US. Before we get started, we’ve written these blogs about moving to and living in Israel which you may enjoy. What to do when you get kicked out of your US… -

November 4, 2024|

November 4, 2024|- Moving to Israel

The US Presidential Elections – some thoughts going in for expatsIn this blog, we discuss how the results of the US Presidential Election are likely to affect US expats. Before we get started, we’ve written these blogs about moving to and living in Israel which you may enjoy. What to do when you get kicked out of your US brokerage account Can one use a… -

September 30, 2024|

September 30, 2024|- Moving to Israel

Dealing with US Retirement Assets for US divorcees who live overseasThis blog was originally published by Hait Family Law. No two divorces are the same from a financial perspective. When it comes to US persons living overseas, the domicile of the divorcing couple (i.e. likely future ex-couple), leads to extra layers of complexity. We assume for the purposes of this article that the divorcing couple… -

August 26, 2024|

August 26, 2024|- Moving to Israel

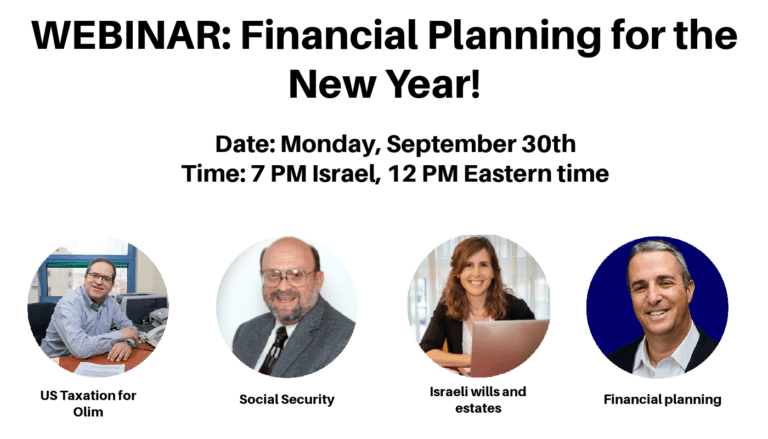

WEBINAR: 5785 Rosh HaShanah Special: Key Financial Planning Issues for US OlimWe will take a deeper look at the top financial questions posed to us in past webinars. We will cover the most perplexing US expat questions pertaining to taxation, estate planning, Social Security, Medicare, Aliyah finances and more. 5785 reasons to attend – (here are some key items that came up on previous webinars) And… -

August 22, 2024|

August 22, 2024|- Moving to Israel

What Do I Need a Tax Transfer Certificate For?Navigating cross border taxation as an expat living abroad can be confusing and challenging while one is alive. It can be even more so for heirs after death! In this blog we are going to discuss why you may need a tax transfer certificate if you are a US expat. Before we get started, we’ve… -

July 29, 2024|

July 29, 2024|- Moving to Israel

Social Security Spousal Benefits & The Non-US SpouseLike many US expats living overseas who qualify for Social Security benefits, many questions arise, especially when a non-citizen spouse is involved in the picture. So is your non-US spouse eligible for spousal benefits? In most cases, the answer is yes; but the requirements are complicated and they change depending on which country you may… -

June 25, 2024|

June 25, 2024|- Moving to Israel

WEBINAR: US-Israel Estate Planning – Common Pitfalls to AvoidEstate planning for US citizens living in Israel can be a complex endeavor, especially for persons who made Aliyah as adults, and who have significant assets still in the US, including property and trusts. -

May 1, 2024|

May 1, 2024|- Moving to Israel

How to Determine Your Israeli Residency Status: a guide for ExpatsIf you spend part of your time both in Israel and the US, whether as an expat or a digital nomad of the post Covid economy, it can be difficult to ascertain whether you are a resident of Israel or not. So, how do you know if you are an Israeli resident and liable for… -

April 24, 2024|

April 24, 2024|- Moving to Israel

Everything a US expat needs to know about Social Security – and isn’t afraid to ask!In this webinar with Social Security expert Tom Clark, we will cover the most pressing questions that a US expat would have about Social Security, such as: Date: Tuesday, May 28th Time: 7 PM Israel, 12 PM Eastern time Speakers: Tom Clark, Social Security speaker and consultant Norman H. Chait, CFA – Managing Principal, Nardis… -

March 20, 2024|

March 20, 2024|- Moving to Israel

Can I Get Social Security Benefits While Living Outside the US?Can US expats get Social Security benefits if living overseas? If one is working in any of the following countries, then he or she is eligible to earn work credits towards US Social Security while being employed in said foreign country: Israel unfortunately is not on this list, and expats living in Israel who are… -

March 7, 2024|

March 7, 2024|- Moving to Israel

Retiring in Israel for US Citizens – Taxation and Planning IssuesRetirement and taxes for US persons in Israel can indeed be a complex endeavor, especially if the retirement assets (e.g. IRA and 401k) are in the US. This webinar will focus on the key issues in preparing for your retirement, specifically taxation and financial planning. We will also touch briefly on Social Security and inheritance… -

January 10, 2024|

January 10, 2024|- Expats

- |

- Moving to Israel

What to do when the Israel Ten Year Tax Holiday EndsWEBINAR DETAILSDate: Tuesday, February 6th, 2024Time: 7 pm Israel, 12 noon eastern The Israeli Income Tax Ordinance provides benefits to new immigrants (Olim) and returning citizens, making Aliyah an attractive option. But what do you do when the 10 Year Tax Holiday ends?Attend our webinar and learn:How the Israel 10 Year Tax Holiday benefits Olim…

Subscribe to Our Newsletter

Stay up to date and receive the latest from Nardis, with resources such as our monthly blog and access to complimentary webinars.Subscribe to Our Newsletter

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact